Mortgage Blog

Your 2026 Homeownership Roadmap: Smart Strategies for Buying, Refinancing, and Building Wealth

January 21, 2026 | Posted by: Matt Shepherd

TherealestatelandscapeinBurlington,Ontario,andthesurroundingGreaterTorontoandHamilton Area (GTHA) is constantly evolving. As we look toward 2026, homeowners and prospective buyers are facing a unique set of opportunities and challenges. Whether you are planning to purchase your very first home, looking to leverage equity for renovations, or navigating a mortgage renewal in a changing interest rate environment, having a strategic roadmap is essential.

At Jason Woods - TLC Mortgage Group, we believe that a mortgage is more than just a monthly payment—itisapowerfulfinancialtoolthat,whenmanagedcorrectly,canbuildlong-termwealth. This comprehensive guide will walk you through the smart strategies you need to succeed in the 2026 property market, tailored specifically for residents of Burlington, Oakville, Hamilton, and beyond.

1. The 2026 Market Outlook: Why Strategy Matters

Asweapproach2026,thedaysof'setitandforgetit'mortgageplanningarebehindus.Volatilityin the market means that working with a dedicated Mortgage Broker in Burlington is more valuable than ever. Unlike big banks that offer a 'one-size-fits-all' product, a broker provides access to over 40 lenders, ensuring you get a solution tailored to your specific financial blueprint.

WhethertheBankofCanadaadjustsratesorhousinginventoryfluctuatesinHaltonRegion,your strategy should focus on three core pillars:

• Affordability: Ensuring your monthly cash flow is manageable.

• Flexibility: Choosing mortgage products that allow for life changes (like moving or breaking a

term).

• Wealth Creation: Using your home to improve your net worth through equity growth.

2. For First-Time Home Buyers: Getting Your Foot in the Door

EnteringthehousingmarketinBurlingtonorHamiltoncanfeeldaunting.However,withtheright preparation, 2026 can be the year you transition from renting to owning. The key is starting the process early—well before you start attending open houses.

The Power of a Solid Pre-Approval

Many buyers mistake a simple online pre-qualification for a formal Mortgage Pre-Approval. They arenotthesame.Apre-approvalfromJasonWoodsinvolvesathoroughreviewofyourfinances, credit, and income. It provides a concrete price range and locks in an interest rate for a specific period (typically 90 to 120 days), protecting you from rate hikes while you shop.

InacompetitivemarketlikeBurlington,averifiedpre-approvalsignalstosellersthatyouarea serious buyer, which can be the deciding factor in a multiple-offer scenario.

Credit Improvement Strategies

Yourcreditscoreisthegatekeepertothebestinterestrates.Ifyourscoreisn'twhereitneedstobe, don't panic. We offer guidance on Credit Improvement to help you boost your score before you apply.Simplesteps,suchasreducingutilizationratiosorcorrectingerrorsonyourcreditreport,can save you thousands of dollars in interest over the life of your mortgage.

3. Strategic Refinancing: Unlocking Your Home's Potential

Ifyoualreadyownahome,youaresittingonavaluableasset.MortgageRefinancingisastrategic move that allows you to access up to 80% of your home’s value. In 2026, smart homeowners are using refinancing for two primary reasons: Debt Consolidation and Renovations.

Debt Consolidation: The Cash-Flow Fix

High-interest consumer debt (credit cards, lines of credit, car loans) can cripple your monthly budget.Byrollingthesehigh-interestdebtsintoyourmortgage,youcansignificantlyloweryour total monthly payments.

Why consider Debt Consolidation?

• Lower Interest Rates: Mortgage rates are typically much lower than credit card rates (which can exceed 19.99%).

• Single Monthly Payment: Simplify your finances by managing one payment instead of five or six.

• improved Credit Score: Paying off revolving debt balances can boost your credit score quickly.

Financing Renovations

LoveyourneighborhoodinBurlingtonbutoutgrowingyourhouse?Insteadofmovingandincurring land transfer taxes and realtor fees, many homeowners are choosing to renovate. Whether it’s a new kitchen, a finished basement, or an addition, refinancing can provide the funds needed to increase your property value and your quality of life.

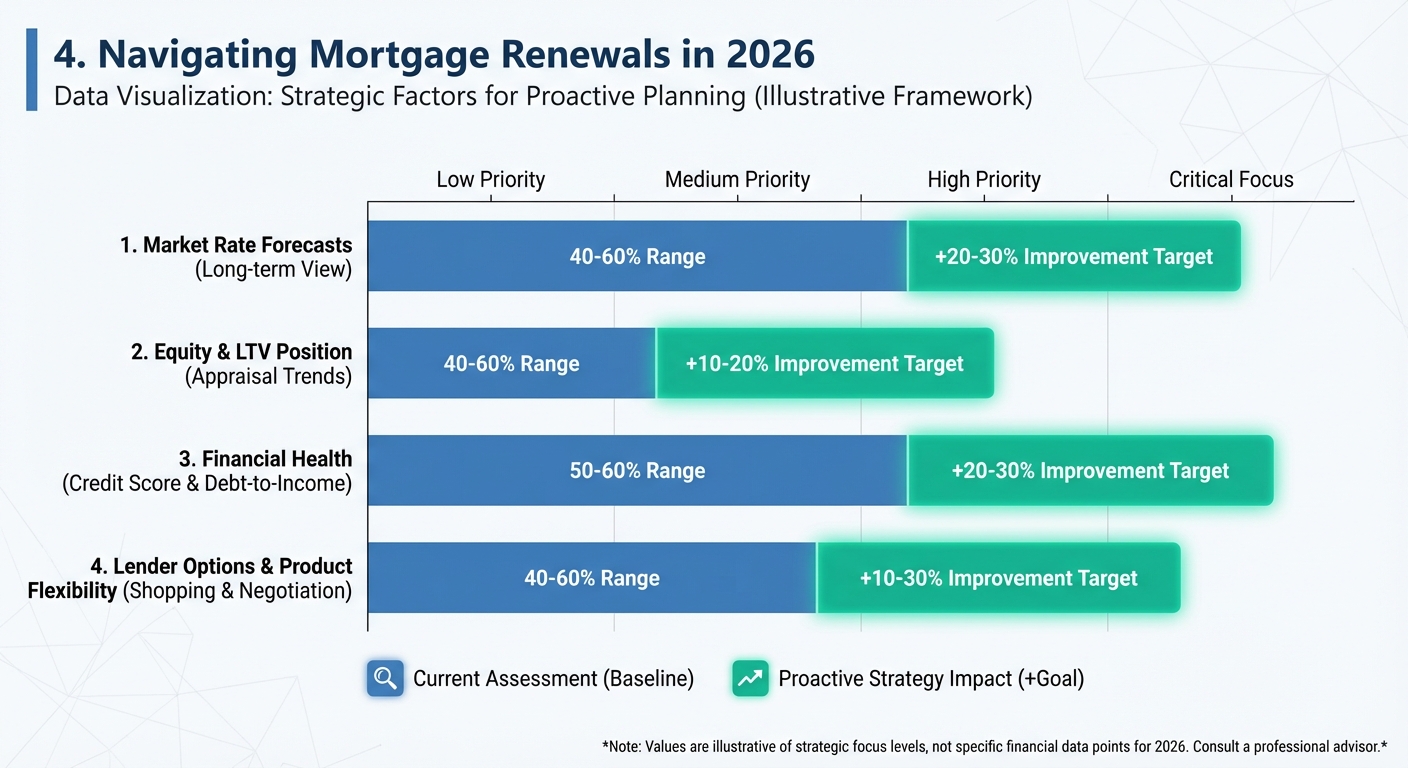

4. Navigating Mortgage Renewals in 2026

Ifyourmortgagetermisendingin2026,youwillreceivearenewalslipfromyourlender.Donotjust sign and return it.

Mortgage Renewals are the perfect time to renegotiate everything pertaining to your mortgage. Yourcurrentlenderiscountingonyourcomplacencytoofferyouaratethatmaynotbethemost competitive in the market. By working with Jason Woods, you can shop your renewal to multiple lenders. We often find that other lenders are willing to offer better rates or cover transfer costs to win your business.

Tip:Starttherenewalconversation4to6monthsbeforeyourmaturitydatetosecurethebest options.

5. Specialized Lending Solutions

Noteveryborrowerfitsintothestandard'9-to-5'box.AtTLCMortgageGroup,wespecializein helping clients who require a more tailored approach.

Mortgages for the Self-Employed

Business owners often write off expenses to reduce their tax burden, which can make their net income appear lower than it actually is. This often leads to rejection from traditional banks. We haveaccesstolenderswhounderstandSelf-Employedborrowersandcanusestatedincomeor business bank statements to qualify you for the mortgage you deserve.

New to Canada

Starting a new life in Canada is exciting, but building a credit history takes time. We offer specializedprogramsforthoseNewToCanada.EvenwithlimitedCanadiancredithistory,wecan help you secure financing to buy your first home in the GTA, helping you put down roots and build equity immediately.

6. Building Wealth: Investment Properties and Vacation Homes

• Investment Properties: Use the equity in your current home to fund the down payment on a rental property. This creates a secondary income stream and diversifies your investment portfolio.

• Vacation Homes: Have you dreamed of a cottage in Muskoka or a winter escape? We can structure financing for second homes and Vacation Homes that fits your lifestyle without overextending your budget.

7. The Broker Advantage: Why Choose Jason Woods?

When planning your 2026 roadmap, who you partner with matters. Here is a comparison of why workingwith an independent broker offers a distinct advantage over walking into a bank branch.

|

Feature |

Jason Woods (Mortgage Broker) |

Traditional Bank |

|

Lender Access |

Access to 40+ lenders (Banks, Credit |

Access to only their own proprietary |

|

Interest Rates |

Wholesale rates negotiated on |

Posted rates; limited ability to |

|

Customization |

Tailored solutions for Self-Employed, |

Strict qualifying criteria ('The Box'). |

|

Availability |

Available via cell, text, and email |

Restricted to branch hours and |

|

Advocacy |

Works for YOU, not the lender. |

Works for the bank's shareholders. |

Frequently Asked Questions (FAQs)

1. How early should I start the Mortgage Renewal process?

It is best to start reviewing your options 4 to 6 months before your current term expires. This allows ustolockinarateearly.Ifratesdropbeforeyourrenewaldate,wecanusuallyadjustitdown,butif they rise, you are protected.

2. Can I get a mortgage if I have bad credit?

- Whilemajorbanksmayturnyouaway,asabroker,Ihaveaccessto'B-lenders'andprivate lenders who focus on equity rather than just credit scores. We can secure you a mortgage now while helping you implement a plan to improve your credit for future refinancing at better rates.

3. Is it difficult to get a mortgage if I am Self-Employed?

Itcanbedifficultatabank,butnotwithabroker.Weworkwithlenderswhooffer'StatedIncome' programs specifically designed for business owners. We look at the broader picture of your business cash flow rather than just line 15000 on your tax return.

4. Does getting a pre-approval hurt my credit score?

A single inquiry for a pre-approval has a negligible impact on your credit score. The benefits of knowingyourbudgetandholdingaratefaroutweighthetemporary,minordip(usuallylessthan5 points) that might occur from a credit check.

5. What fees do I pay to use a Mortgage Broker?

In most standard residential mortgage transactions (OAC), my services are free to you. The lender paysthebrokerafinder'sfeeforbringingthemthebusiness.Yougetexpertadvice,rateshopping, andnegotiationatnocost.Feesmayapplyonlyinspecializedalternativelendingscenarios,which are always disclosed upfront.

Ready to Map Out Your 2026 Mortgage Strategy?

WhetheryouareinBurlington,Oakville,Hamilton,orToronto,yourfinancialfuturedeservesexpert attention.Don'tleaveyourmortgagetochanceoracceptthefirstofferfromyourbank.Let’sbuilda mortgage solution that fits your life and helps you achieve your wealth goals.